In recent years, few Republican talking points have been regurgitated as often as the myth that almost half of Americans pay no taxes. Just last week, House Majority Leader Eric Cantor complained "we have to question whether that's fair," insisting "you've got to discuss that issue."

And that could be a real problem for some on the right. After all, Ronald Reagan and George W. Bush respectively expanded the bipartisan Earned Income Tax Credit and Child Tax Credit which has helped reduce or eliminate the income tax bill for many low income working families. (It was President Reagan who called the EITC "the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress.") And now, some leaders on the religious right are fretting that the GOP's draconian Romney-Ryan budget plan will do away with the vital protections for the "least of these."

The first warning shot at Republicans came from the U.S. Conference of Catholic Bishops, which warned Congress that "a just framework for future budgets cannot rely on disproportionate cuts in essential services to poor persons" and protesting that "the House-passed budget resolution fails to meet these moral criteria." After Jesuit Father Thomas J. Reese of Georgetown University lamented that "I am afraid that Chairman Ryan's budget reflects the values of his favorite philosopher Ayn Rand rather than the gospel of Jesus Christ," Paul Ryan laughably responded, "I reject her philosophy."

Now, Tony Perkins of the Family Research Council is adding his voice to the chorus of family groups lobbying Congress to preserve the Earned Income and Child tax credits. As The Hill reported, the same man who only this week called President Obama's birth certificate a "legitimate issue" circulated a Tax Day petition that urged Congress to not only extend the credit but also expand it:

"We can expect lawmakers to pontificate about fairness and take a few election-year roll calls, but don't expect any serious efforts to be made in addressing this important issue," Tony Perkins, the group's president, wrote to supporters. "That is why we need your help."

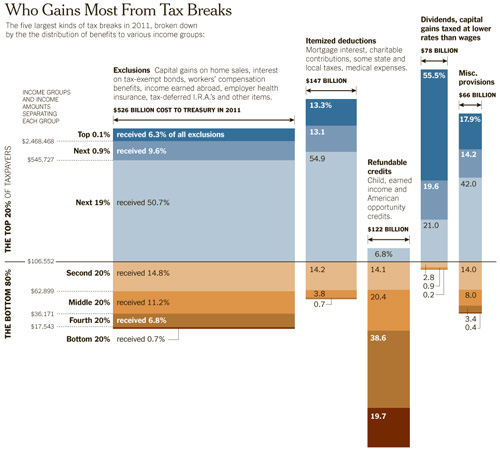

As this

New York Times chart of "

Who Gains Most from Tax Breaks" shows, those two tax credits are among the few helping lower income Americans:

The Child Tax Credit was first signed into law by President Clinton in 1998 and doubled to $1,000 a child by President Bush. But that level is set to expire at the end of 2012, a blow to the 35 million families who claimed $52 billion in child tax credits. The Earned Income Tax Credit had a $63 billion price tag last year.

Created in 1975, the EITC "a refundable federal income tax credit for low-income working individuals and families" that results in a tax refund to those who claim and qualify for the credit when the EITC exceeds the amount of taxes owed. As the Center for Budget and Policy Priorities first detailed in 2005, the EITC has not only been extremely successful in reducing poverty, it has enjoyed broad bipartisan support:

The Earned Income Tax Credit has been found to produce substantial increases in employment and reductions in welfare receipt among single parents, as well as large decreases in poverty. Research indicates that families use the EITC to pay for necessities, repair homes and vehicles that are needed to commute to work, and in some cases, to help boost their employability and earning power by obtaining additional education or training.

The EITC has enjoyed substantial bipartisan support. President Reagan, President George H. W. Bush, and President Clinton all praised it and proposed expansions in it, and economists across the political spectrum - including conservative economists Gary Becker (a Nobel laureate) and Robert Barro, among others - have lauded it.

As CBPP also explained recently, only about 15 percent of

those who pay no federal income taxes are exempt due to the Earned Income, Child and other tax credits. Another 20 percent are "elderly people who benefit from tax provisions to aid senior citizens." A much larger group—almost half—have no income tax bill from Uncle Sam "because their incomes are so low that they are less than the sum of the standard deduction and personal and dependent exemptions for which the household qualifies."

Nevertheless, the Republicans' hated 47 percent pay lots of other taxes, and at the state and local levels often pay more of their income than their wealthier fellow citizens. As David Leonhardt of the New York Times detailed:

The reason is that poor families generally pay more in payroll taxes than they receive through benefits like the Earned Income Tax Credit. It's not just poor families for whom the payroll tax is a big deal, either. About three-quarters of all American households pay more in payroll taxes, which go toward Medicare and Social Security, than in income taxes.

And as

Ezra Klein recently explained in the

Washington Post:

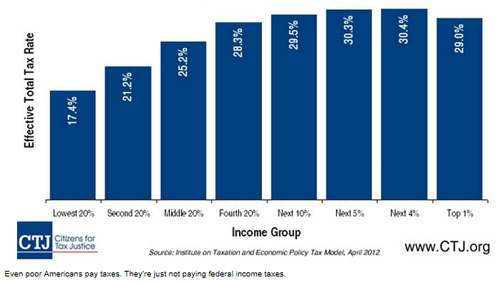

But when we focus on the federal income tax, we miss all the taxes that low-income Americans do pay. The payroll tax, for instance. And state sales taxes. And lots of local taxes. Indeed, Citizens for Tax Justice, a left-leaning tax policy group, produces a study every year showing the total tax burden for different groups once federal, state and local taxes are taken into account. And when you include all the taxes people pay, then, as you can see in the graph atop this post, it turns out that most Americans do pay taxes, and they in fact pay about as much as the rich.

Of course, for years many Republican leaders have been sharpening their knives in anticipation of killing the EITC and other low-income tax breaks for those they mocked as "lucky duckies." Thanks to the crusading efforts of Phil Gramm and other Republicans in Congress, David Cay Johnston explained, "In 1999, for the first time, the poor were more likely than the rich to have their tax returns audited."

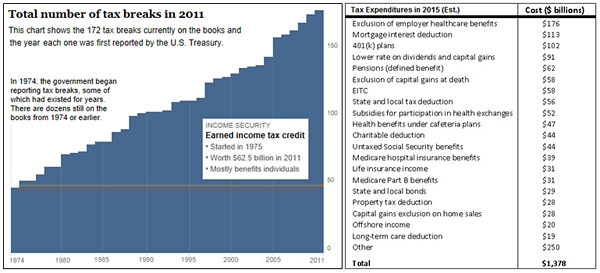

Now, the Republicans have those supposed lucky duckies in their sights again. Paul Ryan's House GOP budget and Mitt Romney's economic plan call for reducing the U.S. national debt by closing some of the deductions, loopholes and other tax expenditures that cost the U.S. Treasury over $1 trillion a year. Predictably, neither Romney nor Ryan has the courage to publicly say which ones they will target for so-called "base broadening." Is it the $89 billion home mortgage interest deduction? The carried interest exemption that allows Mitt Romney to pay a 13.9 percent tax rate? We just don't know because they just won't say. (That's also why both the Ryan and Romney plans as currently proposed would produce trillions in new debt.)

For his part, Majority Leader Cantor has made clear both who he wants to pay more and who he plans to protect. Asked by ABC's Jon Karl if he was saying need to have a tax increase on the 45 percent who right now pay no federal income tax, Cantor responded:

"I'm saying that, just in a macro way of looking at it, you've got to discuss that issue. [...] How do you deal with a shrinking pie and number of people and entities that support the operations of government, and how do you go about continuing to milk them more, if that's what some want to do, but preserve their ability to provide the growth engine? [...] I've never believed that you go raise taxes on those that have been successful that are paying in, taking away from them, so that you just hand out and give to someone else."

Leave aside for the moment that

income inequality is at 80 year highs and the

total federal tax burden is at 60 year low even as upper class rates continue to fall. Jesus said "blessed are the meek," but not "winner takes all." Or as

Father Reese put it:

"Survival of the fittest may be okay for Social Darwinists but not for followers of the gospel of compassion and love."

* Crossposted at Perrspectives *