The Center for American Progress publishes the best and most detailed suggestion for a Democratic starting position in the upcoming budget sequestration debate, I've seen so far, in Next Round of Deficit Reduction Must Tackle Hidden Spending in the Tax Code: How to Avoid the Sequester and Achieve Truly Balanced Deficit Reduction in the Wake of the Recent ‘Fiscal Cliff’ Deal.

I've been googling sequestration cuts since the new year and mostly find mostly articles from defense industry lobbyists, or Republicans, talking about their strategies for substituting social spending cuts for the 50% of the sequestration cuts to defense spending scheduled to kick in on March 1, 2013. Here, finally, is the best progressive plan I've encountered, which proposes a plan to achieve the rest of our efforts to balance the budget with increased revenue.

As Washington heads into the next round of budget negotiations, congressional Republicans are again asserting that every dollar of future deficit reduction must come from cutting government programs and services, not from additional revenue. Congress has already cut spending substantially, however: Three-quarters of the $2.4 trillion in deficit reduction that had been enacted since 2011 has been in the form of spending cuts, and only one-quarter has come from increasing revenue. While Congress raised the top marginal tax rate in the recent legislative deal to avoid the fiscal cliff, it has not even begun to tackle the vast array of tax breaks that disproportionately benefit upper-income Americans, nor has it addressed the many loopholes enjoyed by large corporations. These special tax breaks must be on the table going forward if Congress is committed to a balanced approach to solving our fiscal challenges.

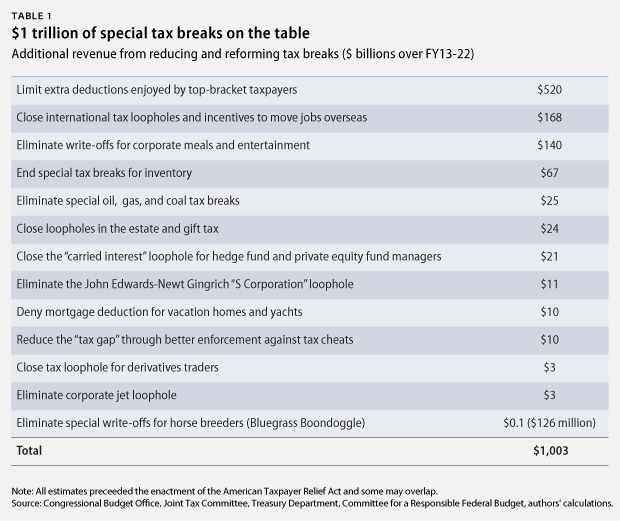

This issue brief identifies about $1 trillion in potential savings over 10 years that can be gained from reducing or reforming tax breaks for high-income individuals and corporations. That amount would be more than enough to replace the so-called sequester, the sudden and indiscriminate cuts to government programs that are now scheduled to take effect starting in March.

These common-sense reductions in tax breaks are far preferable to many of the alternatives: allowing the sequester to kick in; enacting deeper cuts to discretionary spending programs, which have already been cut to the bone; or reducing Social Security, Medicare, or Medicaid benefits.

In this well documented, extensive analysis, Seth Hanlon notes that only if we were to use increased tax revenues to achieve the next $1 trillion of budget balancing measures would we be able to bring the ratio of spending cuts to revenue increases over the last two years close to 1 to 1.

Table 1 suggests gaining over $520 billion by limiting tax deductions to top-bracket taxpayers.

While such a plan may appear to have little political chance, now, unless we try to change public perceptions we are likely to get the Republican plan which will include no additional revenue, and substitute social spending for the scheduled cuts to defense spending.