It's hard to overestimate just how foolish is Marco Rubio's assertion that the deficit causes higher unemployment. Those with basic macroeconomic literacy already understand this, but it's a pretty simple concept easily explained in four steps.

1. Nations are not like households. If a nation goes into debt it can print more money, or float deficits indefinitely. However, there are potential problems with each. They are, in order:

1a. If a nation prints too much money, it can lead to inflation, which decreases the value of the money a nation prints.

1b. If a nation floats too much debt for too long, it can lead to higher interest rates on the nation's bonds. This is sort of like an individual's credit score going down, making it more expensive for them to hold debt on their credit card. If a nation finds it difficult to borrow then it cannot invest in creating government or private sector jobs, which leads to forced austerity.

2. However, The United States is not experiencing either inflation or high interest rates on its debt. The dollar is not inflating at a rapid pace. Meanwhile, treasuries are cheaper than they've ever been--i.e., the interest rate on the nation's credit card is better than ever before. Put in personal terms, there are several agencies that control a nation's bond rating, just like there are several agencies that control your personal credit score. S&P is like Experian in that sense, and the investors and nations buying U.S. debt are like credit card companies. But what if Experian lowered your credit score, but VISA and American Express starting giving you even better rates on your credit card? It would mean that VISA and American Express don't trust Experian. That's what happened when S&P downgraded U.S. credit supposedly because of our deficits: the buyers of U.S. debt didn't care. So the deficit hasn't impacted inflation or borrowing costs. It might so do at some point in the future, but it's not doing so currently nor do we have any reason to believe it will do so in the near future.

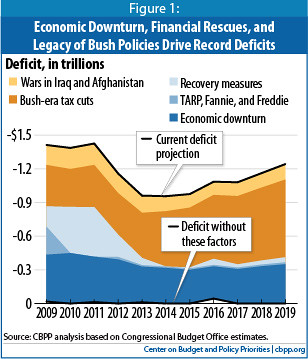

3. The deficit is actually shrinking as we speak. Ezra Klein has the stats:

Remember also that the biggest driver of the deficit is the poor economy: fewer consumer purchases lead to fewer revenues in the form of taxes, which in addition to a greater need for social welfare spending to keep people on their feet leads to bigger deficits. In fact, deficits and recessions are intrinsically linked throughout U.S. history. As economic activity and more importantly civilian employment pick up, deficits inexorably shrink.

In addition to the weak economy, our modern deficit is also a product of George W. Bush's tax cuts for the wealthy and the multiple wars overseas.

Why is the deficit shrinking? Mostly, because of the pickup in economic activity. The elimination of some of the tax cuts for the wealthy will also help. The Affordable Care Act will also be taking a bite out of our extravagant healthcare costs.

4. None of this has any impact on unemployment. Generally speaking, there are two kinds of jobs: public sector and private sector. Even though the private sector is doing better, public sector jobs are still declining due to conservative policies theoretically designed to reduce deficits. Private sector jobs, meanwhile, depend on consumer demand--not corporate profit. American corporations are experiencing record profits, but they aren't hiring because there's not enough middle-class consumer demand for them to hire workers.

4a. The lack of consumer demand leading to poor private-sector job growth in spite of record profits has nothing to do with deficits or uncertainty in the investing climate. It has everything to do with income inequality and economic insecurity among the middle and lower classes.

4b. The obsession over deficits among conservative politicians is directly responsible for public sector job cuts that are helping to drive up the unemployment rate and kill consumer demand.

All of which means that politicians like Marco Rubio who insist that the deficit is directly hurting employment are either so ignorant of economics that they shouldn't be handling public policy, or so cynically manipulative that they shouldn't be handling public policy.

And no "reporter" in Washington or elsewhere should be covering Rubio's statements without providing a basic lesson in macroeconomics as context for his fact-free response.

Cross-posted fromDigby's Hullabaoo