President Obama is in the midst of a so-called 'liberal pile on' (by that meaning his base taking him to task for a cruel, pointless and politically stupid manoever of releasing a budget proposal that incorporates a social security benefit cut) and rightly so. However while I agree completely with the reason for said pile on - Chained CPI is an unconscionable benefit cut to the most vulnerable people in the social security population - I think another part of his proposal, that to 'means test' medicare, that is, to limit the benefits medicare pays by income and financial assests, is even worse and is more pernicious in that it seems to reflect a lack of understanding how medicare works, as well as an undermining of the whole idea.

Come below as MichiganChet explains it all to you

First, as most people who are familiar with medicare can tell you, the program already imposes modest means testing: Part B of medicare, which pays for physician services and related medical needs such as physical therapy, preventive care and so forth is in part financed by a monthly premium that increases for those who have incomes greater than 85,000 per year. Part D works in similar fashion, although since the administration of this was farmed out to private insurance companies it is both more complex and more costly than if the federal government would have administered the program itself. What is important to remember is that medicare pays for only about 48% of the average beneficiarie's health care expenses (According to the Kaiser Family Foundation, whose website, www.kff.org is a very useful source of information when considering health policy), and that healthcare costs, although not rising as fast as they once were, have significantly outpaced inflation over the past 20 years. Thus even the moderately weathy elderly - a distinct minority - face substantial healthcare costs over their lifetime

Medicare was created with a social insurance model in mind; The idea that everyone contributes so that everyone is vested in a system that pays out according to need, which in terms of health care is something that most people will eventually use. There is no way in which medicare would be viable if it were financed in the usual way private insurance does (the ACA aside) which is to charge policy holders premiums that reflect the cost of insuring them; this would render health care insurance for the elderly unaffordable. Means testing in part undoes this social contract that everyone pays in a certain percentage of income in exchange for defined benefits; it decreases the stake that a wealthy beneficiary would have in the overall system. Moreover (and this is a conservative idea) it acts as a disincentive for work and saving, a point that even the right wingers acknowledge: This guy who is writing for the conservative 'National Affairs" says

The right, meanwhile, has tended to oppose means tests for economic reasons. Chief among them is that reducing a person's government benefits as his outside income increases creates a disincentive to work and save. In other words, means tests can produce implicit taxes every bit as harmful as explicit taxes. And since we want individuals to work and save more to provide for themselves in retirement (let alone to sustain the American economy), it would be both counterproductive and unfair to penalize them for doing exactly that

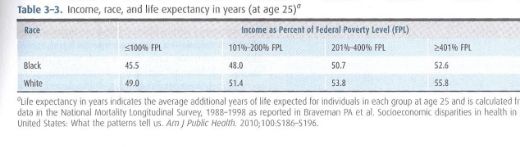

Moreover means testing could cause the wealthy to drop out of medicare, which would be a problem, as they are generally healthier than their poorer couterparts, and thus implicitly subsidize the program for the poor. Check out this table that, shamelessly lifted from one of my teaching health poolicy textbooks, makes this point

There is other data, a plethora, really that supports this idea that rising income, at least in this country, equals better health, for a variety of reasons. If you were running an insurance plan, would you want to piss off the policy holders who cost you less?

Moreover, let us consider the alternative minimum tax. This was initially designed for wealthy people to get them to pay some income tax, back in the days before tax reform meant there was an awful lot of loopholes that could be gamed so that you essentially paid no income tax. Problem was this was not indexed for inflation, so that ultimately a high percentage of taxpaying households, not all of them particularly weathy, wound up paying the tax and thus seeing an increase in tax rates. I should not that I am one of them, and it kinda pisses me off, plus the yearly 'fix' makes it harder to plan. Who doubts that this means testing would not be inflation indexed, meaning people of modest means wouldn't be progressively caught into it as well? 85,000 in the next few years may not look like a huge amount of money, especially if one lives in a high cost of living area.

What also fries me about this idea - which probably wouldn't even save that much money - is that there are other ways to decrease medicare costs without hurting its beneficiaries. I have already mentioned that part D was farmed out to private insurance; well the ACA cut - and there could be further cuts to - part C subsidies which basically pay HMOs to provide seniors with medical care that the federal government could pay for itself with 14% expense. Further, Medicare doesn't negotiate drug prices with the pharmaceutical firms or devices with the device manufacturers, another significant cost savings, which probably wouldn't insulate the President from the invariable political attacks of 'He cut your medicare!', but might actually make some economic sense. And of course any comparative research which might actually really bring down costs by showing what medical treatment is and is not effective seems to be off the table at the moment; even the relatively toothless Independat Payment Advisory Board is savaged politically every time it comes up in congress. Why toothless? again, let me quote the Kaiser Family Foundation, this time from their blurb on the health care reform:

The Board is prohibited from submitting proposals that would ration care, increase taxes, change Medicare

benefits or eligibility, increase beneficiary premiums and cost-sharing requirements, or reduce low-income

subsidies under Part D. Prior to 2019, the Board is also prohibited from recommending changes in payments

to providers and suppliers that are scheduled to receive a reduction in their payment updates in excess of a

reduction due to productivity adjustments, as specified in the health reform law.1 The law establishes specific

rules and deadlines for Congressional consideration of the Board’s recommendations, and specific timelines and

procedures for Congressional action on alternative proposals to achieve equivalent savings

And we are instead going to 'means test' individuals?

I guess I could do worse than quote Lynn Stuart Parramore alternet's highly accomplished senior editor, who wrote a nice piece in December exploding this means testing meme

The United States is a rich country, and a dignified retirement for our elderly should be one of our proudest achievements. And yet Social Security and Medicare are under near-constant attack. Pensions are vanishing, and despite 401(k)s and other voluntary retirement plans, workers still can’t save nearly enough to retire securely...The financial stability of Americans is further shaken by rising medical costs. A single-payer system would be the most sensible way to address this crisis, and Medicare is the closest thing we have now to single-payer. Means-testing would harm seniors who already have paltry incomes. Proposals to increase premiums for 25 percent of beneficiaries, for example, could hit American seniors who make as little as $47,000, according to the nonpartisan Kaiser Family Foundation

.

What we really have here, in the final analysis is a refashioning of this chained CPI- this idea that the deficit is so dastardly, that balancing the government's books in the short term takes such a high priority, that we kick those who spent a lifetime working and paying into a benefit program that has been such a social success in the American 20th century. For modest cost savings, so we can reach some sort of 'bargain' with John fu**ing Boehner.

Please. We think over here.