A recent paper by the Minneapolis Federal Reserve has gotten a lot of attention. The paper is titled Facts and Myths About the Financial Crisis of 2008 and it argues there was in fact no credit crisis. Several people have used this paper to argue that Wall Street overstated the severity of the credit crisis in order to get a bail-out they didn’t need. What these commentators have failed to heed is this paper was widely criticized within the financial community, even drawing a rare rebuke from a sister Federal Reserve Bank. In short, to argue there was no credit crisis -- to say we were "punked by wall street" – flies in the face of every available fact on the crisis.

First, let’s provide some background for this debate. As of this writing 311 lenders have "imploded. The XLFs – the ETF that tracks the financial sector – is down almost 70% from a high in the summer of 2007. Total credit losses at the world’s financial institutions have totaled 1 trillion dollars:

The gauge is down 46 percent in 2008 as credit losses and writedowns at the world’s largest banks surpassed $1 trillion and the U.S., Europe and Japan entered the first simultaneous recessions since World War II.

In other words, the financial sector’s economic position is terrible at best.

But the evidence runs deeper. About every six weeks the Federal Reserve issues a paper titled "The Beige Book. This is a book complied from anecdotal evidence from the Federal Reserve Districts on the general economic environment. Every Beige book issued in 2008 has indicated credit conditions were tightening and loan demand was decreasing.

January 16, 2008:

Reports from banks and other financial institutions noted further declines in residential real estate lending, and lending to the commercial real estate sector was generally described as mixed. Some Districts reported lower consumer loan volumes, whereas the volume of commercial and industrial lending varied. Most Districts cited tighter credit standards.

March 4, 2008:

Most Districts reporting on banking cite tight or tightening credit standards and stable or weaker loan demand.

April 16, 2008:

Financial institutions in many Districts indicated some deceleration in consumer loan demand, tightening in lending standards, and deterioration in asset quality

June 11, 2008:

Lending activity also varied across Districts and market segments, though tighter credit standards were reported for most loan categories.

July 23, 2008

In banking, loan growth was generally reported to be restrained, with residential real estate lending and consumer lending showing more weakness than commercial lending.

September 3, 2008

Most Districts reported easing loan demand, especially for residential mortgages and consumer loans; lending to businesses was mixed.

October 15, 2008:

Credit conditions were characterized as being tight across the twelve Districts, with several reporting reduced credit availability for both financial and nonfinancial institutions

December 3, 2008:

Lending contracted, with many Districts reporting reductions in residential, commercial and industrial lending and tightening lending standards.

In addition to the Beige Book, the Federal Reserve issues a Senior Loan Officer Survey every three months. These reports stated the following:

January 2008:

In the January survey, domestic and foreign institutions reported having tightened their lending standards and terms for a broad range of loan types over the past three months. Demand for bank loans reportedly had weakened, on net, for both businesses and households over the same period.

April 2008:

Compared with the January survey, the net fractions of banks that tightened lending standards increased significantly for consumer and commercial and industrial (C&I) loans. Demand for bank loans from both businesses and households reportedly weakened further, on net, over the past three months, although by less than had been the case over the previous survey period.

July 2008:

In the current survey, large net fractions of domestic institutions reported having tightened their lending standards and terms on all major loan categories over the previous three months. In particular, the net fractions of banks that had tightened credit standards on consumer loans increased notably relative to the April survey.

October 2008:

In the current survey, large net fractions of domestic institutions reported having continued to tighten their lending standards and terms on all major loan categories over the previous three months. The net percentages of respondents that reported tightening standards increased relative to the July survey for both C&I and commercial real estate loans, as did the fractions reporting tightening for all price and nonprice terms on C&I loans.

Finally, there is the quarterly banking profile from the FDIC. Here is the summary from the most recent report:

Troubled assets continued to mount at insured commercial banks and savings institutions in the third quarter of 2008, placing a growing burden on industry earnings. Expenses for credit losses topped $50 billion for a second consecutive quarter, absorbing one-third of the industry's net operating revenue (net interest income plus total noninterest income). Third quarter net income totaled $1.7 billion, a decline of $27.0 billion (94.0 percent) from the third quarter of 2007. The industry's quarterly return on assets (ROA) fell to 0.05 percent, compared to 0.92 percent a year earlier. This is the second-lowest quarterly ROA reported by the industry in the past 18 years. Evidence of a deteriorating operating environment was widespread. A majority of institutions (58.4 percent) reported year-over-year declines in quarterly net income, and an even larger proportion (64.0 percent) had lower quarterly ROAs. The erosion in profitability has thus far been greater for larger institutions. The median ROA at institutions with assets greater than $1 billion has fallen from 1.03 percent to 0.56 percent since the third quarter of 2007, while at community banks (institutions with assets less than $1 billion) the median ROA has declined from 0.97 percent to 0.72 percent. Almost one in every four institutions (24.1 percent) reported a net loss for the quarter, the highest percentage in any quarter since the fourth quarter of 1990, and the highest percentage in a third quarter in the 24 years that all insured institutions have reported quarterly earnings.

Before we even get to the Minneapolis Federal Reserve Report we’ve clearly established the following.

1.) There have been over 300 failures of various lenders

2.) The financial industry has taken over $1 trillion in losses since the start of this crisis

3.) Financial stocks are down almost 70% since the summer of 2007 making it nearly impossible for institutions to raise additional capital in the equity market.

4.) Each Beige Book issued in 2008 indicated a troubled credit market

5.) Every loan officer survey issued in 2008 indicated tightening credit standards and decreasing loan demands

6.) The FDIC’s latest Quarterly banking profile showed massive losses for the US banking industry along wither serious deterioration in asset quality.

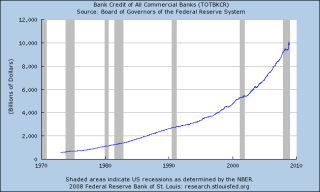

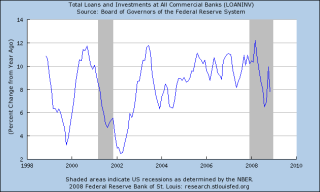

In the face of the preceding facts the Minneapolis Fed argues "here we examine three claims about the way the financial crisis is affecting the economy as a while and argue that all three claims are a myth." Their first claim is because there was no decrease in outstanding credit the claims of a credit crunch are overblown: "These figures show that their claim, that banks have essentially stopped lending to non-bank entities is false, at least as of October 15." Unfortunately this argument runs in the face of economic history. Here is a chart of total US bank credit outstanding:

What does this chart tell us? There are two important facts.

1.) The latest recession is the only recession where total credit outstanding has leveled off for an extended period. (The first recession in the 1980s saw a contraction but only after total credit increased). While it didn't decrease it also didn't increase. Compare this to the previous 6 recessions when lending increased at least slightly throughout the recession. In other words, the leveling off of credit creation is a story in and of itself.

2.) In order for the US economy to grow it must have a continual supply of new credit. A leveling off is just as hazardous as a decline.

And that is what happened during most of 2008. The graphs contained within the Minneapolis Federal Reserve report show a clear leveling off of total outstanding credit for most of 2008. Again - this is the only recession in the last 40 years where this has happened.

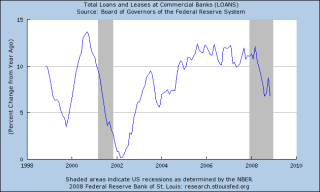

And Professor Mark Thoma who runs the blog Economists View offers this rebuttal:

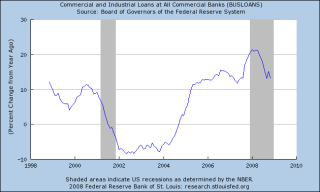

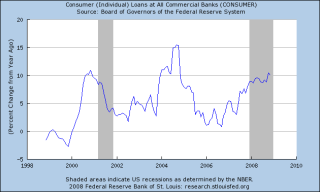

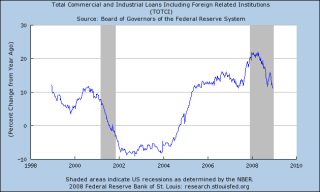

Here is every loan series the Federal Reserve Band of St. Louis finds it worthwhile to report in FRED (the title of the section is "Banking: Loans"). These are all percentage changes in quantities (expressed in billions of dollars) from a year earlier, not prices:

Professor Thoma concludes:

I realize that growth rates are still positive and relatively high in some cases -- even real estate loan growth remains above previous troughs -- and that can be interpreted as lack of evidence of a big problem. But I thought the claim was there is no evidence of a fall off in loan activity. The graphs above show there has been an impact, it's not negative yet, but there has been a sharp downturn. It also suggests that if the downturn follows previous patterns - and hopefully Fed intervention or private sector adjustment will prevent that (see the hopeful signs at the end of some of the series above) - but if it does repeat the pattern, we still have a long way to go before things turn around.

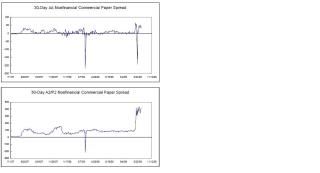

And then there is this rebuttal from Tyler Cowan:

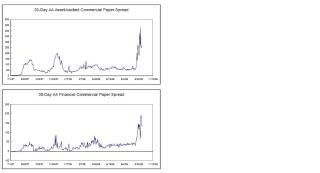

First of all, some of the conclusions drawn are simply false. While rates on the highest quality non-financial commercial paper have behaved fairly well in recent weeks, rates for lower quality stuff have soared. The spread between the two, actually, is one of Calculated Risk's credit market indicators.

The failure to distinguish between the two types of paper is indicative of the broader, unwarranted credulity of the authors. For instance, many of the series they present actually show an unusual spike in bank lending during the crisis period. Are we to understand that for most banks, conditions actually improved, suddenly, sharply, and atypically while the rest of the financial world went to hell? Well, we might do that. Or we might suspect that the increase in bank lending was itself a product of tight credit conditions elsewhere—that borrowers were falling back onto lines of credit they normally wouldn't use thanks to the severity of lending conditions.

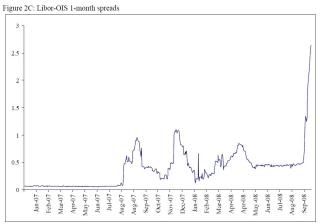

And all of this occurs before we get to a rare rebuttal from a sister Federal Reserve Bank. The Bank of Boston issued a paper titled Looking Behind the Aggregates, a Reply to Facts and Myths About the Financial Crisis of 2008. This paper notes the large spikes in several key short-term rates:

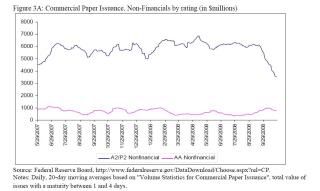

And then there is the large drop-off in non-investment grade commercial paper issuance:

Finally, there is the Treasury market. On Friday I wrote the following on my blog:

What the Minneapolis Fed report fails to take into account is inflation in one reason for investors to purchase Treasury bonds. Another is safety. Because US Treasury bonds are considered the safest in the world people buying them at a high rate means Treasuries are yielding an incredibly low rate right now. Some T-Bills have recently been issued at 0% interest! That in and of itself tells us the level of concern is abnormally high and a credit crunch is indeed going on - people don't want any return; they simply want their money back!

In short, inflation expectations are one reason why people buy Treasury bonds. But another very important reason is safety. And investors are clearly concerned mostly with safety right now if they don't even want a return on their investment.

In short – we were not "hoodwinked" by Wall Street. There was and is a serious problem with the financial system that needed fixing in a serious and immediate way. To argue differently flies in the face of all available facts.