By Chris Lilienthal, Third and State

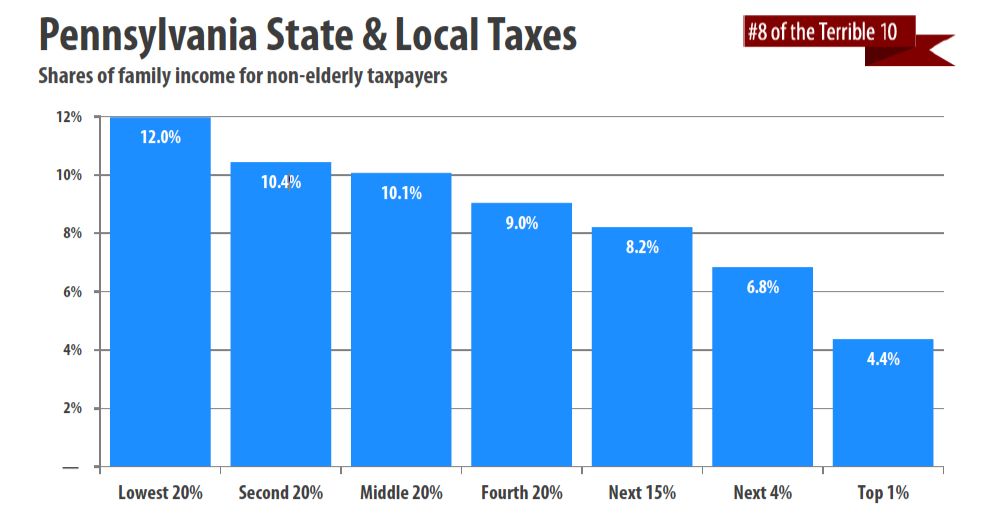

Working families in Pennsylvania pay a far higher share of their income in state and local taxes than the state’s wealthiest earners, according to a new study by the Institute on Taxation and Economic Policy (ITEP).

Pennsylvania’s tax system scored so poorly that it made the list of the “Terrible 10” most regressive tax states in the nation.

The Pennsylvania Budget and Policy Center (PBPC) co-released the report, Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, with ITEP. PBPC Director Sharon Ward made the point in a press release that "No one would deliberately design a tax system where low-income working families pay the greatest share of their income in taxes, but that is exactly the type of upside-down tax system we have in Pennsylvania.”

Middle-income families in Pennsylvania pay more than double the share of their income in taxes than the very wealthiest Pennsylvanians, while low-income families pay nearly three times as much as top earners, the report found. Get more details on the report, including a Pennsylvania fact sheet, here.

The report should bury once and for all the myth of the makers vs. the takers. Low-income families in Pennsylvania are paying much more of their income in state and local taxes than the top 1%.

Families who qualify for state personal income tax forgiveness still pay large shares of their earnings in sales, local income and property taxes, the report found. At the same time, wealthy taxpayers benefit greatly from tax laws that allow them to write off property and income taxes from their federal taxes. This is, at best, a modest benefit for middle-class families and no benefit to very low-income earners.

Pennsylvania’s flat income tax contributes to its regressive tax ranking. Without a graduated tax rate that rise on more affluent earners, the state’s income tax does little to offset more regressive sales and property taxes.

That's why Pennsylvania should amend the state Constitution to enact a graduated personal income tax. Even without a constitutional change, the state could set a higher income tax rate on investment income, which goes primarily to wealthy Pennsylvanians, without raising the rate on wage earners.