The World sees our National Debt (investing in our T-Bills) as a "Flight to Safety;" as Opportunity.

In fact, a significant portion of Americans see it the same way: Don't bet against America -- but rather Invest in America.

Flight to Safety and U.S. Treasury Securities (pdf)

by Bryan Noeth and Rajdeep Sengupta

Government debt of the United States is typically issued in the form of U.S. Treasury securities. These securities—simply called Treasuries -- are widely regarded to be the safest investments because they lack significant default risk. Therefore, it is no surprise that investors turn to U.S. Treasuries during times of increased uncertainty as a safe haven for their investments. This happened once again during the recent financial crisis. In fact, the increase in the demand for Treasuries was sufficiently large so that prices actually rose with an increase in the supply of government securities.

[...]

In summary, there has been a large expansion in the amount of Treasury security offerings while yields on Treasuries have actually declined. Stated differently, the prices on Treasury securities have actually increased in the face of a rapidly expanding supply of these securities. This anomalous behavior in the market for Treasuries can be explained by a significant increase in the demand for Treasuries -- “the flight to safety” in the event of a financial crisis. Evidently, the effect of the increase in the supply of securities in government auctions was more than offset by the increase in investors’ demands for safer investments.

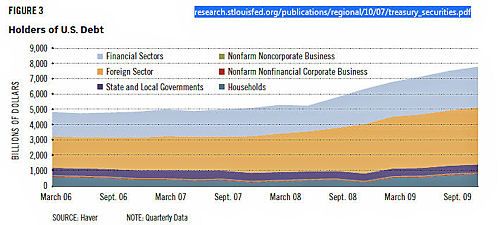

Who Holds This Debt?

Figure 3 shows the quarterly flow of funds data on the holdings of U.S. Treasuries by various sectors of the economy. Prior to the crisis, the proportion of Treasury securities held by each sector of the economy was roughly unchanged over the early part of this decade. The largest shares of available Treasury securities have been held by the domestic financial sector and the rest of the world. Post-crisis, these two sectors saw the most dramatic increases in their share of Treasury securities holdings. Interestingly, it seems that although the U.S. was at the epicenter of the financial crisis, both foreign and domestic investors still sought the safety of U.S. government debt instruments. These data present evidence in support of the hypothesis that investors see U.S. Treasuries as relatively risk-free. However, it will be interesting to see how investors view U.S. securities in the future as debt levels continue to rise.

Rajdeep Sengupta is an economist at the Federal Reserve Bank of St. Louis.

Bryan Noeth is a research analyst at the Bank.

larger image

That widening

tan band in the chart, looking from left to right -- that's "The World" stepping up to

invest in America, in these sketchy times of global economic turmoil.

That smaller, but widening dark-blue band in the chart, looking from left to right -- that's "US Households" who know better than to actually bet against America. Not in the long run.

In fact, Lending money TO the USA (ie buying in our T-Bills) is such an attractive "piggy bank" for some countries -- that some are willing to PAY US for that privilege -- willing to take on Negative Bond Rates, all to have a guaranteed seat on that Flight to USA Safety.

It's a chaotic world out there. Some Economies become mired in recession. Demand and growth trends can falter. Brutish rulers can get overthrown.

One thing remains certain though, the USA is NOT going away -- not any time soon.

Recently, the US Treasury made it "easier" for foreign countries (other than China) to stake their claim in this US "sense of certainty" -- they began offering T-Bills more suitable to worldwide market demand for them.

They will be offering T-Bills which easily support Negative Interest Rates (payback rates). For those fledgling countries, intent on owning a "piece of the Rock" too.

U.S. Treasury Plans Floating-Rate Notes in Year or More

by Meera Louis & Cheyenne Hopkins, bloomberg.com -- Aug 1, 2012

The U.S. Treasury Department said today it is developing a floating-rate note program that could be operational in a year or more, while it is preparing for possible negative-rate bidding.

[...]

Record Low

[...]

The Treasury also said it is “in the process of building the operational capabilities to allow for negative-rate bidding in Treasury bill auctions, should we make the determination to allow such bidding in the future.”

Investors who bid at auctions for Treasury bills at negative yields would pay more than face value for the securities, ensuring that if they hold the debt to maturity they will get back less than they paid.

[...]

Now this is more than green-shaded bean-counter chatter. This "flight to safety" is a powerful and direct counterpoint to the hysteria about the "out-of-control" National Debt, that the Tea Party props are constantly

whining about.

Austerity Hawks like them are actually afraid to invest in the future of America. Funny, the rest of the world isn't. Funny that.

This global T-Bill trend was not loss one Progressive thinker-economist, who saw it for the Economic-engine it really is ... if only we were brave enough to leverage it.

Ezra Klein astutely notice this frame-twisting factoid:

Nations are willing to PAY us, to LEND us money ...

... to keep their money safe and secure.

That's simply amazing. That is simply not understood well enough.

Ezra Klein:

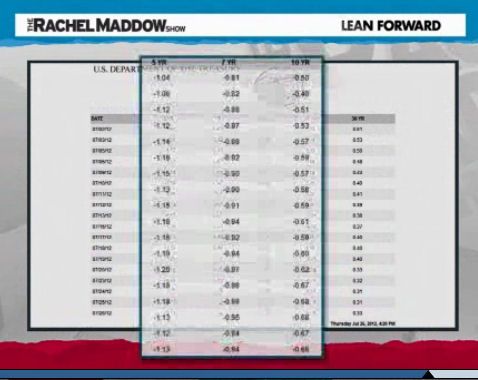

You see all those minus signs, they mean people are lending us money (once you account for inflation) at negative interest [rates].

They are PAYING us to hold onto their money -- safely -- because 'We are America' and the world is scary right now. And we are not scary.

Ezra Klein:

The time for investing in our infrastructure is now. Right Now.

Doing anything less, isn't just missing an opportunity -- it is Financial Mismanagement on an epic scale.

Ezra for Rachel, last July:

"Runways are NOT supposed to be Gooey."

by jamess -- Jul 27, 2012

Silly US, for not taking them up on the offer ... all because Austerity Hawks are too afraid to invest in the Jobs of the 21st century.

In their world view, all our aging bridges and roads, and broken water lines, and last century power grids, and aging airports, and crumbling and understaffed schools,

-- that those things will all just somehow, FIX THEMSELVES ... by some sort "Republican osmosis."

Otherwise known as "pinching pennies" ... "No stitch in time" ... "straining at gnats"

Penny wise, dollar foolish. ... No guts, no glory future!

Republican osmosis: Keep bailing ... the storms will end soon. (We think.)

PS. The Tea Party assures us, we cannot afford to Fix the Roof. Not now. Not ever.