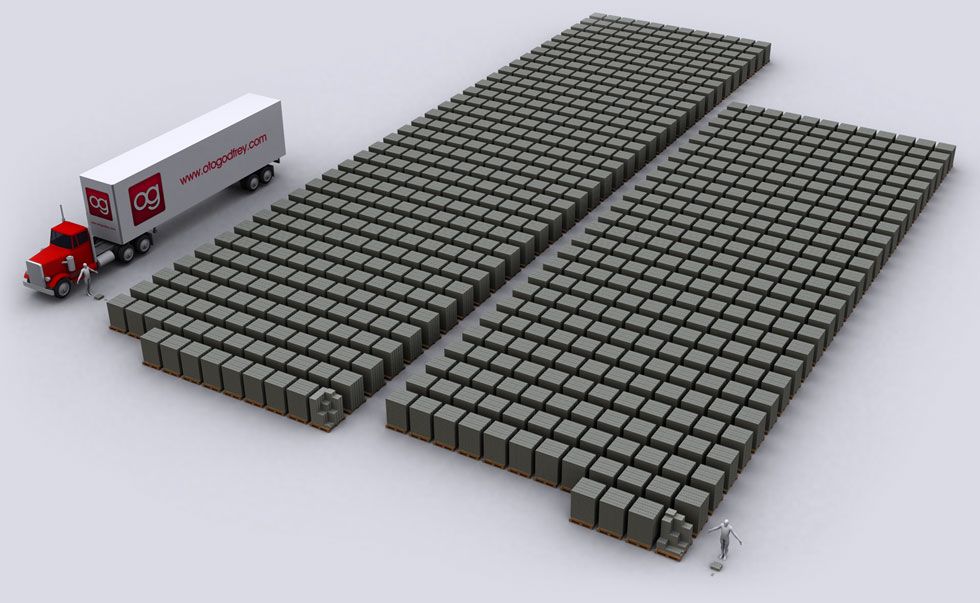

I personally think much of what drives the Tea Patry hatred/phobia/hysteria over our out-sized National Debt-- is that they've visited one too many web-sites like this one, which are long on scary visuals, but short on actual answers:

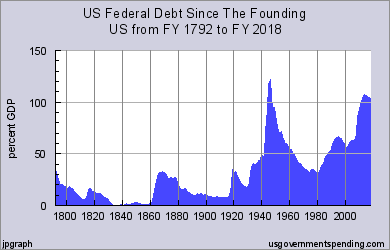

Such Debt-phobic web-sites, paint a very bleak picture. Often one without relative context or intelligent solutions. Those sites who do dare to offer such prescriptions/constrictions, generally focus on the 'Debt to GDP' metric as a their barometer that 'proves' we "borrow too much," compared to times past:

The GDP theory goes, that if the Economy does good (GDP: Gross Domestic Product) -- then the National Debt will eventually get paid down too, due to the increased economic activity. By some sort of "supply-side" osmosis, I guess. Perhaps by all the extra sales tax on chewing gum purchases ...

There is a new school of thought however, that is challenging that simplistic premise. One that shifts the borrowing focus back to 'Revenues' -- instead of the strength of the Economy (just like banks do before they lend out 'their' cash).

Debt to GDP – The Red Herring of Red Ink

by Alex Engler, Georgetown Public Policy Review -- Oct 10, 2012

[...]

Debt-to-GDP is a favored statistic concerning the debt -- many believe there is no better single number to compare a government’s financial obligation with its citizens’ potential to pay that obligation. This may be true, but this metric is still highly limited and its predictive power is diminished in the case of the United States.

Debt-to-Revenue Ratio

[...]

Yet it is a substantial oversight to ignore debt in relation to government revenue. The economy at large is not directly responsible for paying down the debt -- the federal government is. In light of this, contrasting debt to federal government revenue adds a beneficial context. In fiscal 2012, when the United States collected $2.4 trillion, that ratio was a stunning 464 percent.

Of course, 2012 was a year of relatively low revenue, due both to tepid economic growth and to temporary tax reductions. These factors inflate the debt-to-revenue ratio in the short term, but the fact remains that it is a staggeringly large disparity.

[...]

The thing about the 'Debt-to-Revenue Ratio' is, that it focuses us on

applying the solution --

Raising Government Revenues -- instead of focusing on

the shiny object of 'rising profits' -- that are being garnered by the volume of "stuff" being sold in the overall Economy (GDP). The sale of Product or Services

may, or may NOT,

result in actual increases in Revenues that pay down our Debts -- depending on the current Tax Loopholes and Accountants, available to the richest benefactors of GDP growth.

Remember that Wall Street itself, is fueled by 'Earning and Profits' reports, is it not? This could help explain 'the popularity' of the GDP -- as a 'measure of health' for our overall Economy. A rising GDP, means rising profits, means rising stock prices.

But rising stock prices do not always mean rising Government Revenues. Quite the opposite, when the shiny perks of Capital Gains and CEO Compensation plans, are taken into account. A rising GDP can actually lead to falling Government Revenues, given the Corporate drive for self-preservation at all costs.

In other words, the 'GDP-to-Debt Ratio' is not a very accurate measure of our credit-worthiness -- our ability to pay down the National Debt. It is actual Government Income that pays down our Government Debt -- it's NOT the income of the wealthiest among us that does. They have their Cayman Island ways of avoiding such Government obligations.

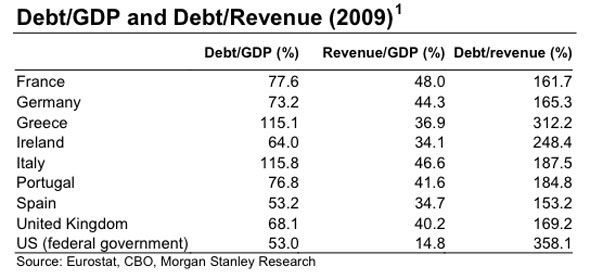

Interestingly, even some of the titans of Wall Street (or their employees) may be starting to see this royal disconnect with linking the Debt to GDP. This analyst from Morgan Stanley makes a strong case for changing our Debt-gauge metrics. It would seem that titans too, may actually WANT TO SOLVE the National Debt problem someday (and NOT just rant and throw tantrums about it).

Forget Debt To GDP, It's Debt To Revenue That Matters -- And The U.S. Is The Worst

by Gregory White, BusinessInsider.com -- Aug. 25, 2010,

[...]

From Morgan Stanley's Arnaud Marès (emphasis ours):

Whatever the size of a government’s liabilities, what matters ultimately is how they compare to the resources available to service them. One benefit of sovereignty is that governments can unilaterally increase their income by raising taxes, but they will only ever be able to acquire in this way a fraction of GDP. Debt/GDP therefore provides a flattering image of government finances. A better approach is to scale debt against actual government revenues (see Exhibit 2). [...]

And Morgan Stanley put together a chart to make that comparison. The U.S. position, relative to its ability to raise revenue, looks weak compared to Europe:

As any household owner knows {I know a Sovereign Government IS different that a Household --

but still 'people relate' to this analogy}, you can't have

Out-go without Income. If your debt is nearly

4 times (400% of) your income, you might be a tad over-extended. A smart person would

start "doubling up" on their credit payments then; (they wouldn't

"doubling down" on refusing to pay their bills, as those in the Tea Party are all too ready to do.)

Well, without the Revenues coming into the IRS [Income], the US National Debt [Out-go] will most likely just keep growing -- given the forces of inflation and compassion and infrastructure decay, already baked into our national cake. Most Americans like our level of Civilization. Living in a fortified bunker, is not on the Majority's To-Do List.

Unfortunately the Tea Patry hordes have a hatred/phobia/hysteria about Paying Taxes too which provides for our "quality of life." It seems they think that Society (aka our 'general welfare') will somehow magically heal itself, somehow magically pay for itself, if only the GDP-Job-Creators are given enough 'economic bribes' for them to finally kick-start the Economy. These Wealth Creators however in the Tea Party worldview, should NEVER be asked to pay one red-cent more in Taxes -- Because THAT could hamper the GDP!

SO, the next time you meet a Debt-phobic ranter that wants to dismantle the Government piece by piece, ask them if they think the Government has a legitimate right to "collect more revenues" (ie taxes). When they say 'Hell No' -- tell them the Constitution says 'Hell Yes' ... to raising taxes for the benefit of our society.

The Constitution says NOT TO question "validity of the public debt of the United States" (Amendment 14).

The Constitution tells us to "insure domestic tranquility"; to "promote the general welfare"; to provide for our security and for the security of those who will follow us. (The Preamble).

The Constitution DOES NOT say "shut it all down" -- think only of yourself; It DOES NOT say build a bunker, and declare war on the "domestic tranquility" and the "general welfare" of those "others" who also call America "home".

It does say "Raise Taxes" to provide for Society. It does say that MORE than once. (Article I, Section 8; Amendment 16).

THEN ask the Debt-phobic ranter "Do you respect/love/cherish the Constitution?"

When they assert 'Hell Yes!', then tell them "Then pay your damn Taxes. Because that is the basic obligation of being an American. It's in the Constitution."

Of course if we had Economic Metrics that actually linked our Debt to our Revenue -- rather than linking to "our economic activity" -- then all this "personal politicking" would be unnecessary -- since over-time the economic system could become "self-correcting." Revenues could automatically be adjusted to rationally pay-down our "household" Debts. Abrupt halts, full stops, cut everything -- is not a rational policy. And it does not address the real problem -- the very real National Income problem.

And afterall, isn't that what we all want -- to solve our "common" National Problems -- even those who fear our National Debt, above all else?

-- I ask you.