Over the last few months there's been a number of stories about how the 2008-2009 bailouts have netted a profit for the Treasury and Federal Reserve.

There are a couple problems with those stories:

1) they haven't netted a profit, and

2) the bailouts are far from over.

There are also other smaller items of confusion that need to be sorted out. I'm going to try to clear some of this up.

#1: What was the cost of TARP?

For starters, the bailout is/was both larger and smaller than the $700 Billion you remember.

The version that passed Congress on October 3, 2008, was not the version that got implemented. It was changed almost immmediately.

since Congress only authorized $350 billion to be lent out in 2008. The other $350 billion was saved for the new President when he took office in 2009. Obama never used the TARP funds to further bail out banks. Instead, he launched the $787 billion Economic Stimulus package. Second, the government bought bank stocks when the prices were depressed and sold later, when prices were higher. By 2012, banks had repaid $292 billion of TARP funds, leaving only $120 billion still outstanding. These funds were used for the HARP program, to help homeowners facing foreclosure.

The amount of outstanding TARP is even narrower now and headed for an overall profit. Or is it?

Like most things on Wall Street, there are

hidden costs and losses not recognized until well into the future.

The reality is that bailed-out firms essentially wrote off their losses on taxes. As of Dec. 30, TARP was still owed $67.3 billion, including $27 billion in realized losses — which is to say, that money is gone and is never coming back.

Now, TARP is losing money as it tries to exit the programs.

A new report by SNL Financial shows the Treasury Department is taking a beating in auctions of the Capital Purchase Program, one of the pipelines through which bailout money flowed.

The auctions essentially sell off TARP debt and equity to private investors. Unfortunately, investors aren’t really interested in zombie-bank debt. It’s been selling at an 8% to 20% discount. The last auction, on Jan. 25, met with a 35% discount. In all, the latest CPP auction cost taxpayers $104.5 million.

Because of accounting rules, those losses on TARP securities doesn't have to be recognized until it hits the market. Thus it might be several years before we know the final story of how much we lost on TARP.

About 330 banks have exited the TARP bailout, but around 400 smaller banks still remain. The ones that remain are obviously the weaker ones. Of those, 162 are behind on their repayments.

As for the TARP money moved to HARP, none of it will be repayed because it is a subsidy. The CBO estimated that $16 Billion of it will be spent.

One last note about TARP, more than half of the 74 Senators who voted for TARP will no longer be in office by 2015. Only 7 of the 25 Senators who voted against TARP will have left office.

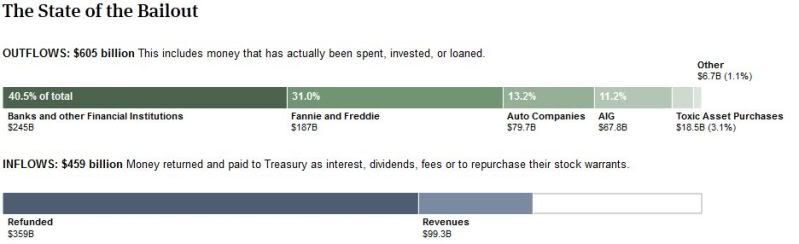

#2: How big was the bailout?

Many are still under the impression that TARP = The Bailout.

In fact, TARP was only a small part of the Wall Street bailout. Most of the bailout was accomplished through the Federal Reserve.

The net total? As of November 10, 2011, it was $29,616.4 billion dollars — (or 29 and a half trillion, if you prefer that nomenclature). Three facilities—CBLS, PDCF, and TAF— are responsible for the lion’s share — 71.1% of all Federal Reserve assistance ($22,826.8 billion).

$29 Trillion is around twice the size of America's GDP.

The Federal Reserve claims they only lent

$1.7 Trillion to the big banks. Why the huge difference in totals? Because the Fed only counts the most outstanding at any one time.

Here's a quick list of the Fed borrowers:

Citigroup - $2.513 trillion

Morgan Stanley - $2.041 trillion

Merrill Lynch - $1.949 trillion

Bank of America - $1.344 trillion

Barclays PLC - $868 billion

Bear Sterns - $853 billion

Goldman Sachs - $814 billion

Royal Bank of Scotland - $541 billion

JP Morgan Chase - $391 billion

Deutsche Bank - $354 billion

UBS - $287 billion

Credit Suisse - $262 billion

Lehman Brothers - $183 billion

Bank of Scotland - $181 billion

BNP Paribas - $175 billion

Wells Fargo - $159 billion

Dexia - $159 billion

Wachovia - $142 billion

Dresdner Bank - $135 billion

Societe Generale - $124 billion

"All Other Borrowers" - $2.639 trillion

Behind the enormous sum, we find certain items of interest. Such as:

The Fed paid $659.4 million in "fees" to these very same institutions during the period in question. This is not part of the bailout.

You might have noticed that about $3 Trillion went overseas.

The banks made $13 Billion from Fed below-market rates. This is not part of the bailout.

The bailout of Fannie and Freddie (which directly assists the banking industry) is still negative $187 billion. They have returned none of the money yet. However, Fannie and Freddie have paid $50.4B in dividends to the Treasury.

OK. So now we have the full picture, right? TARP bailout was a small loser on something around $600 Billion, while the Fed bailout was around $29 Trillion and pretty much a wash, right?

#3: When did the bailout end?

First of all, the Fannie and Freddie bailout is ongoing, and coming straight from the Treasury Department (i.e. taxpayer money).

Secondly, the Federal Reserve bailout of the Wall Street banks hasn't let up even a little bit.

It sometimes takes the form of backdoor bailouts through the courts.

But mostly the ongoing bailout takes the form of legacy costs.

The growth of the Fed’s balance sheet means it could pay $50bn-$75bn a year in interest on bank reserves at the same time as it makes losses and has to stop sending money to the Treasury.

In an interview with the Financial Times, James Bullard, president of the St Louis Fed, said: “If you think of the profitability of the biggest banks, if you’re going to talk about paying them something of the order of $50bn – well that’s more than the entire profits of the largest banks.”

The Fed has payed the Treasury $291 Billion over the last four years from earnings on its ballooning portfolio. However, those assets, purchased through the multiple quantitative easing programs, were bought at a very low interest environment that won't last forever. When interest rates go up, those asset prices will drop fast.

The Fed's costs of its ongoing Wall Street bailout is still completely unknown.